People living with aortic valve disorders such as bicuspid aortic valve often worry about getting life insurance. The good news is that life insurance is possible for many applicants even if they have a bicuspid aortic valve, especially if symptoms are mild and well-managed. Insurance companies look at medical history, current health, and the type of valve issue when deciding if someone is eligible and what their rates will be.

Life insurance with aortic valve conditions may still offer good options, though sometimes the process can feel confusing or stressful. Companies may ask for extra medical records or recent test results during the application. Some insurers are known to be better than others at working with people who have heart-related health issues, which can make a big difference in both approval chances and costs.

Key Takeaways of Life Insurance and Aortic Valve Disorders

- Life insurance is available for people with aortic valve disorders, including bicuspid valves and stenosis, especially when the condition is stable and well-managed.

- Medical records, echocardiograms, and test results are often required to determine eligibility.

- Applicants with mild symptoms and no complications may qualify for standard or near-standard rates.

- Working with an experienced broker familiar with heart-related cases can improve approval odds and help find more favorable policies.

- Policy options vary, from term and whole life to guaranteed issue, depending on health history and timing of diagnosis or treatment.

Types of Aortic Valve Disorders

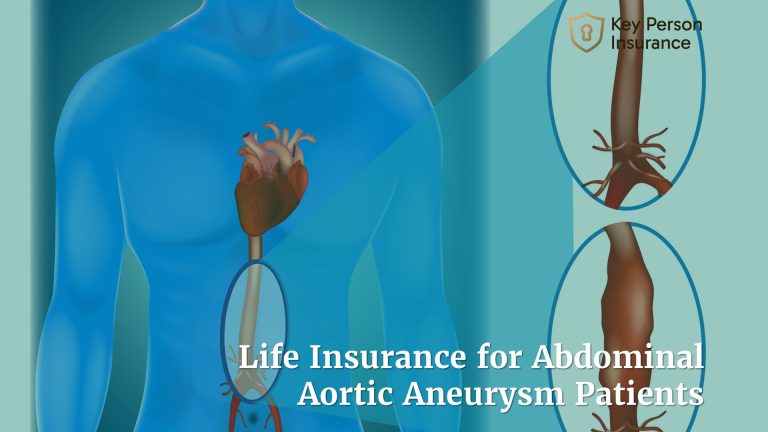

Aortic valve disorders affect how blood moves from the heart to the rest of the body. Problems can arise from birth or develop later and may cause symptoms ranging from mild to severe, impacting daily life and insurance options.

Aortic Valve Stenosis

There are a few main types of aortic valve disease. Aortic valve stenosis means the valve becomes stiff or narrow, making it hard for blood to flow from the heart to the body.

Aortic Regurgitation

Aortic valve stenosis occurs when the valve between the heart and the aorta becomes narrowed, restricting blood flow from the heart to the body. The severity of this condition can range from mild to severe and impacts how well the heart functions.

- Mild Aortic Stenosis typically shows few or no symptoms. Patients may live normally for years without intervention, but regular monitoring is essential to track progression. The valve opening is slightly reduced, and the heart compensates by working a bit harder than normal.

- Severe Aortic Stenosis is more serious. The valve becomes critically narrowed, making it difficult for blood to leave the heart. Symptoms may include chest pain, shortness of breath, dizziness, and even fainting. Left untreated, it can lead to heart failure or sudden cardiac death. At this stage, valve replacement surgery or transcatheter aortic valve replacement (TAVR) is often required.

Some valve disorders are caused by aging, infections, or other heart conditions. Others, like a bicuspid aortic valve, are present at birth and are known as congenital heart disease. People may not know they have valve disease until symptoms begin or a doctor hears a heart murmur during a check-up.

What is a Bicuspid Aortic Valve?

A bicuspid aortic valve is a type of congenital heart defect where the aortic valve has two flaps (cusps) instead of the usual three. This change can make the valve more likely to wear out or leak over time, especially as a person ages.

It is the most common type of congenital heart disease found in adults. Many people with this condition do not have problems right away. However, some will develop valve stenosis or regurgitation as they get older.

Life Insurance Coverage With Bicuspid Aortic Valve

People diagnosed with a bicuspid aortic valve can still qualify for life insurance, but their eligibility, application steps, and needed medical information may differ from other cases. Most life insurance companies focus on heart health, treatment, and any symptoms when reviewing an application.

Eligibility for Coverage

Most people with a bicuspid aortic valve are eligible for life insurance. Approval usually depends on the severity of the valve disorder and if there are extra complications. Those with no symptoms, mild or no valve regurgitation, and normal heart function often find more insurance options.

Rates might be higher if there is a history of surgeries, heart failure, or severe symptoms. Insurance companies also look at overall health, age, and if the person is following their doctor’s advice. Some life insurers are more lenient than others, so it helps to shop around or use a broker for better rates and choices.

Insurance Application Process

The insurance application process for applicants with a bicuspid aortic valve usually involves extra questions and possibly more medical checks. The applicant will have to fill out a detailed medical questionnaire. This covers heart health history, symptoms, and treatments.

Applicants may need a physical exam, and sometimes an insurance company will ask to see test results such as an echocardiogram or stress test. Medical records from a cardiologist may also be required.

Most insurance companies review both recent and past heart test results before making a decision. Processing times can be longer for people with heart conditions. Working with an agent who understands heart disorders can help speed up the application.

Medical Information Required

Insurers asking for coverage after a bicuspid aortic valve diagnosis will want detailed medical records. Expect requests for all heart-related test results, dates of diagnosis, and list of medications used.

Extra information, such as family history of heart disease, might also be requested. Insurers mainly want to see that the condition is controlled and being managed carefully. Prompt and clear medical details help speed up a decision and may improve approval chances.

Impact of Aortic Valve Disorders on Life Insurance Approval

People with aortic valve disorders, such as a bicuspid aortic valve or aortic stenosis, often face extra steps when applying for life insurance.

Risk Factors Evaluated by Insurers

Insurance companies look at several key risk factors when considering life insurance for someone with an aortic valve disorder. These include the specific type of valve condition (such as bicuspid aortic valve or aortic stenosis), the severity of symptoms, and any other related heart problems like heart disease or high blood pressure.

They may also check for a history of heart failure or heart attack, as these conditions can raise the level of risk. Age at the time of diagnosis and how often symptoms occur are also taken into account. People whose aortic valve conditions are stable and well-managed may still qualify for standard rates, while those with more severe or complicated cases may pay more in premiums.

Assessment of Complications

Insurers want to know about any complications connected to the aortic valve disorder. These can include aortic regurgitation (when the valve leaks), aortic stenosis (narrowing of the valve), or a history of heart failure. They also examine past medical events, such as aortic valve replacement surgery and the presence of other heart conditions.

Common complications like irregular heartbeat, past hospitalizations, or needing a pacemaker all influence the approval process. Detailed medical records are usually required to show any hospital stays, test results, and the outcomes of past treatments. This level of detail helps insurers decide what level of risk is present for each applicant. Those with more complications are sometimes offered lower amounts of coverage or higher monthly rates.

Cost and Coverage Options for Applicants

People with aortic valve disorders want to know how much life insurance may cost and what kind of coverage is possible. Factors like the type of valve problem, treatment history, and policy choice can affect prices and options.

Factors Affecting Insurance Premiums

Insurance companies look at several things before setting your premium. The biggest factors include the type of aortic valve disorder, such as bicuspid aortic valve, and how well it is being managed. If someone has had heart valve surgery or their doctor says their heart is healthy, premiums can be lower.

Age, overall health, family medical history, and if there are other heart problems also matter. Smoking or not exercising can push up the cost. Some insurers might require a waiting period after valve surgery, often between 6 to 12 months, before they offer coverage.

Types of Life Insurance Policies

There are a few main policy types for people with aortic valve conditions. The most common life insurance protection are:

- Term Life Insurance: Covers a set number of years, like 10, 20, or 30.

- Whole Life Insurance or Permanent Life Insurance: Lasts a lifetime and builds cash value over the years.

- Guaranteed Issue Policies: No medical exams, but usually have lower coverage and higher costs.

Applicants with stable valve disease can usually apply for term or whole life. Those who had recent surgery or hospital stays might start with a guaranteed issue plan. Each policy type has its own rules about coverage and premiums. For example, young adults with valve conditions can often get a standard policy but might pay higher premiums.

Comparing Coverage Amounts

The amount of coverage you can get depends on your health, medical history, and the type of policy. Healthy people with a repaired valve and no symptoms can usually qualify for more coverage and better financial support.

Typical coverage amounts can range from $50,000 to $1,000,000 or more, but this varies by insurer and policy. Policies with higher coverage will cost more, especially for those with a complex heart problem.

Comparing quotes from different companies is important. Some providers may be more experienced in covering heart valve disorders and offer more affordable life insurance.

Frequently Asked Questions About Life Insurance and Aortic Valve Disorders

What should someone with a bicuspid aortic valve know about applying for life insurance?

Applicants with a bicuspid aortic valve should prepare clear medical history, including test results and details about any treatment. Working with an experienced independent agent who understands heart conditions can help them find better policy choices. Insurance companies will look at the timing of diagnosis, medication use, and any symptoms. Regular doctor visits and good overall health may improve approval chances.

How does a bicuspid aortic valve condition affect life insurance premiums?

Having a bicuspid aortic valve can raise premiums, but the increase depends on several things. Age, how well the valve is working, and if there are other health problems matter to companies. Someone with mild symptoms and good checkup results may pay less than a person with severe issues. Quitting smoking and keeping other health risks under control could help lower the cost.

Are individuals with heart defects like a bicuspid aortic valve eligible for life insurance?

Most people with heart defects such as a bicuspid aortic valve can still get life insurance. They might have to pay higher rates or choose from fewer plans, but many are approved, especially if the condition is managed and they are otherwise healthy.

Conclusion and Summary of Life Insurance and Aortic Valve Disorders

Getting life insurance with an aortic valve disorder, whether it’s a bicuspid valve, aortic stenosis, or regurgitation, is possible in many cases. While the process can be more detailed and involve extra paperwork or testing, people with mild or well-managed conditions are often eligible for competitive rates. The key to success is working with insurers who understand heart-related conditions and providing clear, up-to-date medical records.

Whether you’ve had surgery, are under cardiologist care, or are managing a congenital valve issue, life insurance is still within reach. With the right policy, you can protect your family’s financial future while navigating your health confidently.

trusted by 5,000+ clients

Get Personalized Quotes Tailored to Your Company’s Needs