Key Person Insurance Blog

Explore in-depth resources on key person life and disability insurance, carefully researched and fact-checked by industry experts.

Categories

Life Insurance for Atrial Fibrillation Patients

Living with atrial fibrillation (AFib) can raise a lot of questions about life insurance. People with atrial fibrillation can still

Life Insurance and Aortic Valve Disorders

People living with aortic valve disorders such as bicuspid aortic valve often worry about getting life insurance. The good news

Life Insurance for Angina Patients

Living with angina can lead to many questions, especially about future planning and protecting loved ones. People with angina can

Life Insurance for Prostate Cancer Survivors

Prostate cancer survivors often wonder if they can still get affordable life insurance, and the good news is that many

Life Insurance for Alcoholics

Life insurance is a big decision for everyone, but it can feel even more complicated for people who struggle with

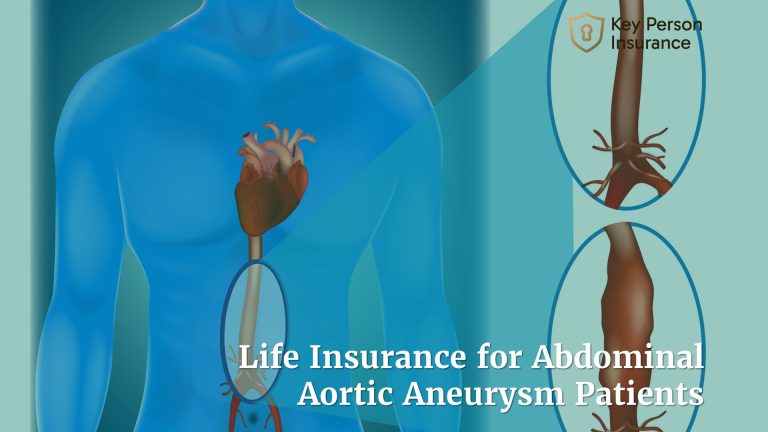

Life Insurance for Abdominal Aortic Aneurysm Patients

Living with an abdominal aortic aneurysm (AAA) brings many questions about health, safety, and the future. One of the biggest

Life Insurance for Migraines & Headaches

Living with migraines and headaches can make daily life more complicated. Many people wonder if having these conditions will affect

Life Insurance for Epileptic Patients with Epilepsy

Living with epilepsy brings unique challenges, and finding the right life insurance is often one of them. Many people worry

A List of Key Man Life Insurance Alternatives

In addition to life and disability insurance, companies have several options available to cover the costs of replacing a key

Business Overhead Expense Insurance

Business Overhead Expense (BOE) Insurance is designed to reimburse the company for certain business expenses should the business owner become

Disability Income Insurance – Is Your Financial Plan Complete?

We offer a wide range of insurance plans to protect your business. Contact us today to learn more about disability

What Is Disability Buy-Out Insurance and Why Would You Want It?

Prudent business owners know the importance of thorough business planning and the impact that the death or disability of a

Key Person Disability Insurance – A Comprehensive Guide

Imagine if your top salesperson, lead project manager, or primary technician were suddenly unable to work for an extended period.

Disability Income Insurance Alternatives

While individual disability income insurance is the most sensible way to protect your ability to earn an income, there are

Disability Insurance Funding for Buy Sell Agreements

Intelligently planned business buy/sell agreements cover the contingencies of voluntary withdrawal, death or the disablement of a business owner. In

Business Succession Planning: A Step by Step Guide

Just like the “cycles” of life, every business must go through “cycles” and face different challenges as it grows and